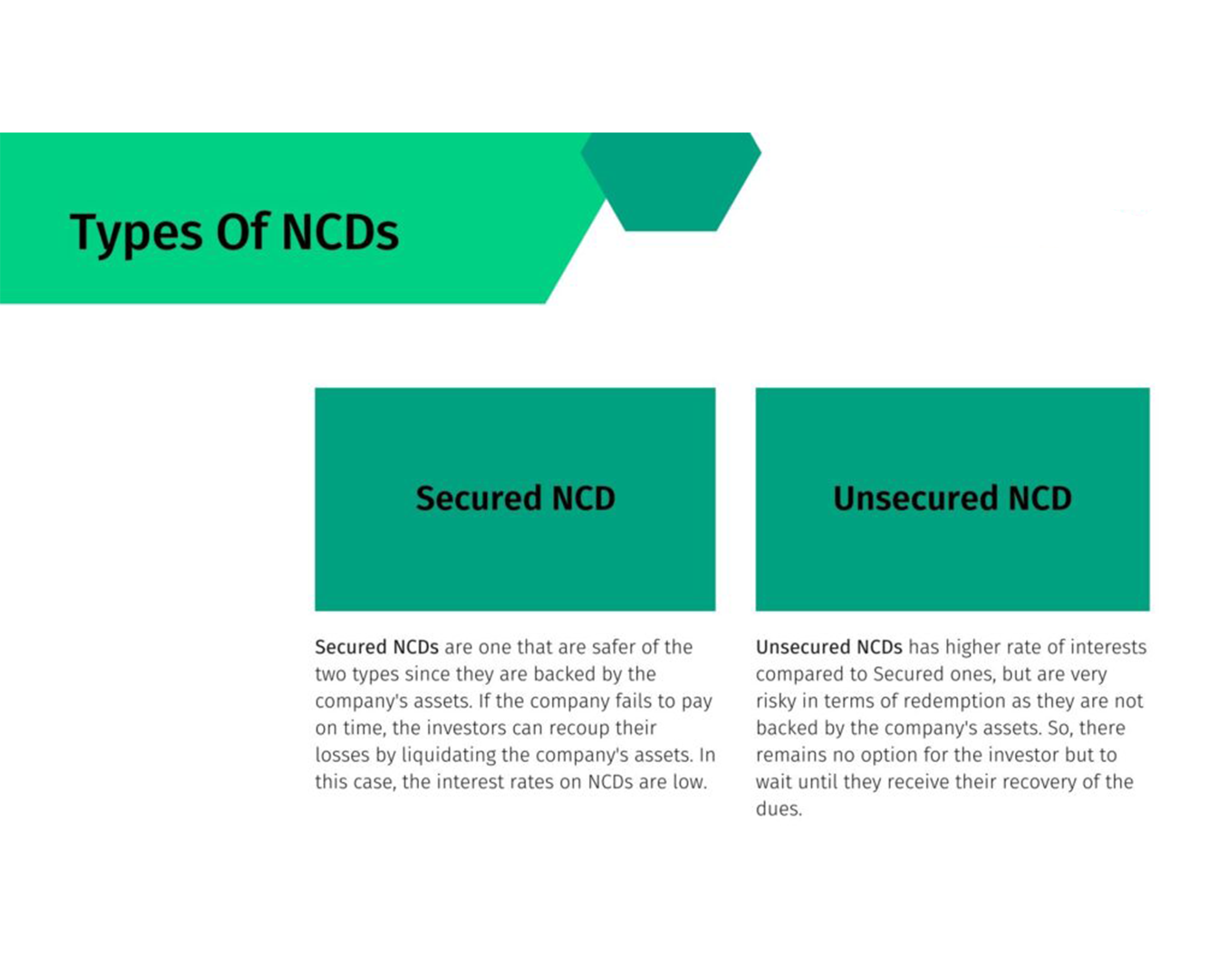

1️⃣ Secured NCD

* कंपनी की assets / property पर charge

* Risk कम, Safety ज्यादा

* Return moderate

Conservative investors के लिए best

2️⃣ Unsecured NCD

* कोई asset security नहीं

* Risk ज्यादा, इसलिए interest ज्यादा

High risk appetite investors के लिए

3️⃣ Listed NCD

* NSE / BSE पर listed

* Secondary market में बेच सकते हैं

* Liquidity better

Liquidity चाहने वाले investors के लिए

4️⃣ Unlisted (Private Placement) NCD

* Exchange पर listed नहीं

* Higher yield मिलता है

* Liquidity limited

HNI / Institutional investors के लिए

5️⃣ Cumulative NCD

* Periodic interest नहीं

* Maturity पर lump-sum payout

Wealth accumulation के लिए

6️⃣ Non-Cumulative NCD

* Monthly / Quarterly / Annual interest

* Regular income source

Passive income investors के लिए

7️⃣ Redeemable NCD

* Fixed maturity date

* Most common type

8️⃣ Perpetual NCD

* Fixed maturity नहीं

* Higher yield

* Mostly banks / NBFC issue करते हैं

Experienced investors only

9️⃣ Fixed-Rate NCD

* Interest rate fixed

* Stable cash flow

Floating-Rate NCD

* Interest rate linked to benchmark

* Rate change हो सकता है

Investor Thumb Rules

* Safety चाहिए → Secured + Listed NCD

* High return → Unlisted / Unsecured

* Regular income → Non-cumulative

* Long-term → Cumulative / Perpetual

✅ Visit www.phixwala.com